Why Clarisonic Is Closing—And What It Means For The Beauty Device Market

Time’s almost up for Clarisonic, the brand behind the facial brush producing 300 movements per second.

On Sept. 30, L’Oréal is shutting down the beauty device trailblazer that convinced consumers to upgrade from hands and wash clothes to cleanse their faces with an oscillating tool. The imminent closure will be an astonishing end to Clarisonic, which L’Oréal indicated has distracted from its core business, and demonstrates relying on a single innovation is extremely challenging in a beauty industry advancing at the speed of social media.

“It’s the death of an era,” says Olamide Olowe, co-founder and CEO of Topicals, a skincare brand exploring devices for future launches. “It was a huge cultural mainstay in the beauty world. Clarisonic is one of the brands that pioneered people taking care of their skin not just when they had a problem, but proactively. I think it’s sad, but it goes to show that the industry is not forgiving. It evolves very quickly, and you have to stay connected to who your consumer is and address their needs.”

Clarisonic is the brainchild of immunologist Robb Akridge, mechanical engineer Steve Meginniss, chemist Ward Harris, and electrical engineers David Giuliani and Ken Pilcher. Ahead of establishing original Clarisonic parent company Pacific Bioscience Laboratories in 2001, the quintet had been involved in Optiva, the inventor of the Sonicare toothbrush that generated $175 million in sales prior to being acquired by Philips in 2000. L’Oréal purchased Pacific Bioscience Laboratories in 2011. In fiscal year 2010, Clarisonic achieved $105 million in sales.

The brand peddled its facial brush at doctors’ offices initially to gain credibility before blanketing retailers such as Sephora, Ulta Beauty and QVC. Early on, prices for its devices ran from $149 to $225. Clarisonic expanded by releasing an entry-level model for $99, varying color offerings and branching into the men’s segment with a facial brush geared to the guys.

Clarisonic’s marriage with L’Oréal was tricky from the beginning. For the conglomerate specializing in skincare, cosmetics and haircare, electronics weren’t familiar territory. Clarisonic brought with it a production facility in Redmond, Wash., that enabled it to keep a close watch on quality control. L’Oréal opted to transition to external production in 2016, the same year it wrote down 234 million euros on the value of the brand. Clarisonic’s yearly sales have been declining of late.

“Clarisonic is one of the brands that pioneered people taking care of their skin not just when they had a problem, but proactively.”

“Home-use devices are not a category that the last owners had previously had experience in, and there is no doubt it is a very niche area of beauty,” says Laurence Newman, CEO of CurrentBody, an e-tailer focus on beauty devices that’s sold Clarisonic since 2010. “By the way, I don’t think it went wrong. The device sold 15 million-plus units. Ultimately, L’Oréal made a strategic decision in their vast portfolio of products.” Of L’Oréal, Dara Levy, founder of beauty device authority Dermaflash, says, “They are not a device-centered brand and their focus is on the easier fish to fry. Color and skincare is a lot easier to sell. It’s a lot easier to innovate.”

Under L’Oréal control, Clarisonic faced a flood of competitors, both copycats undercutting its prices and a serious rival in Foreo, a company that broke into thousands of retailers by 2014 with its silicone devices promising a softer, hygienic facial cleanse. In 2018, Foreo surpassed $1 billion in sales and, today, it calls itself “the world’s top beauty tech company.”

Claudia Teng, co-founder and CPO of Topicals, figures Clarisonic didn’t have the brand equity to hold its own against imitators. “Devices are so flashy. They’re a gadget-y gizmo thing that’s shiny, and the temptation can be to highlight the features of that product, but what helps create brand equity is for people to believe in what’s unique about your brand,” she says. “People won’t necessarily come just for your products, but they’ll come if they know you are supporting something larger.”

As the beauty industry swung its attention to millennial and gen Z consumers interested in strong visuals, missions and self-care propositions, Clarisonic didn’t keep up. “They turned into a dinosaur,” says Sam Alexander, CEO and owner of skincare tool company PMD. “I remember looking at their Instagram account and thinking, ‘Wow, this is crazy. For how big a company they are, they’re still not penetrating social media.’ They weren’t really touching the end consumer in the way they should have.”

In addition to struggling on social media, Clarisonic struggled to respond to changing skincare trends and preferences. In recent years, its scrubbing tool became increasingly viewed as abrasive. In a tweet Wednesday about Clarisonic’s closure, beauty reporter Cheryl Wischhover points out, “Harsh facial cleansing and exfoliating techniques fell out of favor as the double cleanse and acid exfoliators became ascendant.”

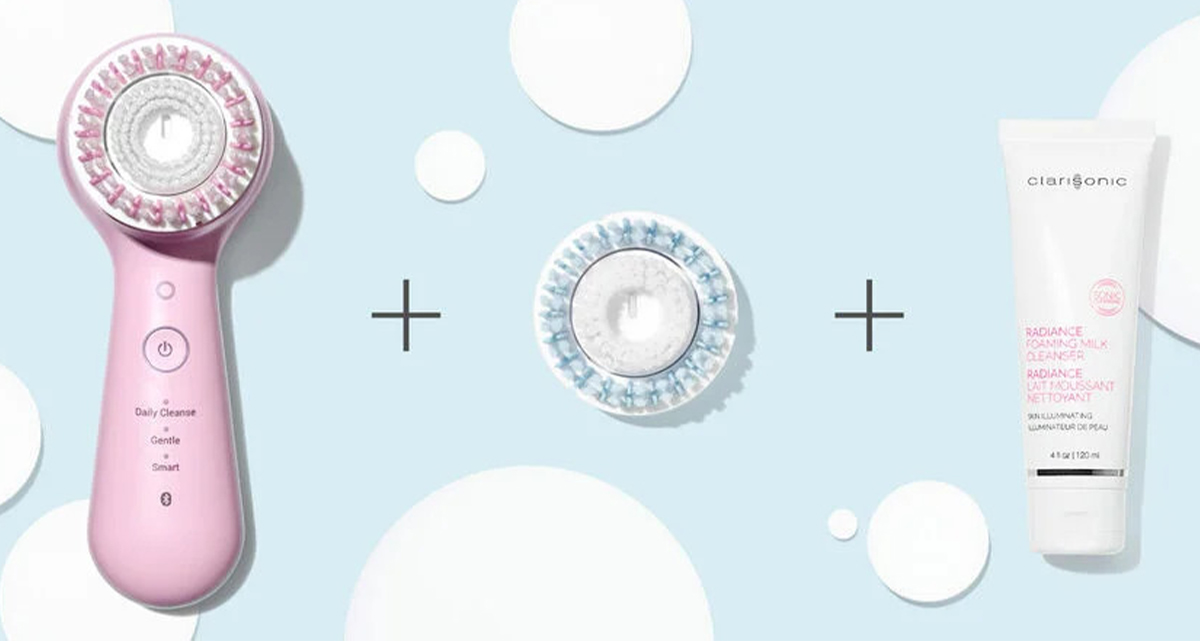

In reaction to shifting preferences and to streamline its assortment, Clarisonic discontinued its products in 2018, and relaunched the devices Mia Prima for $129 and Mia Smart for $229 with a “soft start” option. Explaining the adjustments, Akridge told Elle Canada, “One of the concerns we heard was it’s over-stimulating, it seems too powerful for my skin.” Known for its power, Clarisonic’s pivot to a “soft” approach was a tough pitch.

“The market itself is really, really robust.”

Replenishment was also a challenge for Clarisonic. It had branded topical products to nab margin it wasn’t gaining on devices and encourage purchases outside of them. The topical products, though, were never particularly meaningful sales drivers. Clarisonic depended on infrequent purchases of brush head replacements for replenishment.

Last year, Akridge, hinting at his forthcoming project Opulus in an interview with Beauty Independent, discussed the difficulties of running a beauty device purveyor. “You have to sell a lot of devices to make money,” said Akridge. “And the margins aren’t that great compared to a shampoo or face wash. It used to be you could make 20% on a device if you are lucky versus 70% on a shampoo.”

For a device company to have a healthy business, Alexander figures replenishment should contribute at least 15% to 20% of sales. However, he identifies lack of product and marketing innovation, not replenishment issues, as Clarisonic’s thorniest problem. Clarisonic attempted to break into the makeup category with the Sonic Foundation Brush and push beyond brushes with the Sonic Awakening Eye Massager. The products didn’t catch on like its facial brush.

“Look at Apple. Every year, they have a new iPhone and, somehow, they entice you to get the new one,” says Alexander. “I know there’s a lot of talk about replenishment, but they didn’t position themselves as a brand that creates a product where it’s like, ‘Oh, I want to get the next new one.’ A lot of technology brands have figured that out without replenishment.” Foreo, for instance, is examining microcurrent and IPL technologies for impending products.

Clarisonic’s descent occurred as the beauty device market’s outlook has mostly been positive. Sales of non-electronic gua sha and jade roller tools have been brisk. As a whole, the global beauty device market is forecast to progress at an annual compound growth rate of 18.4% to go from $39.1 billion in 2018 sales to $107.2 billion in 2024 sales, according to VynZ Research. During the pandemic, shutdowns of brick-and-mortar stores, important venues for educating consumers on devices as well as selling them, have impacted the sector, but emerging companies within it report sales upticks online. They stand to make inroads into the market void left by Clarisonic’s exit.

Michael Todd Beauty, a direct Clarisonic competitor in the sonic facial cleansing brush field, is situated to benefit from Clarisonic’s departure. “In our view, Clarisonic is an example of a manufacturer that took its dominant position in the marketplace for granted,” says Lewis Hendler, co-founder and chair. He continues Michael Todd “is fast becoming the destination for safe, affordable and effective beauty device treatments in the comfort of home. Clarisonic, on the other hand, focused solely on prestige with increasingly expensive cleansing brushes in a mature market where more affordable choices are what the consumer wants.”

Levy says Dermaflash is registering a “really nice lift” in sales amid the health crisis. She asserts, “The market itself is really, really robust.” Alexander says PMD’s sales have more than doubled this year from last year. He elaborates, “We are seeing significant growth with COVID because there are a lot of women at home. They can’t go to the spa or some can’t even get their hair cut, so they have the budget” to spend on devices.

Clarisonic’s stumbles will undoubtedly cause investors and strategic buyers to be extra careful about entering the beauty device arena. “There will be potentially lower multiples and maybe a little bit more hesitancy. I just spoke to some M&A people and, right now, there are certain businesses in the beauty market that are doing extremely well through COVID, so I think that will overshadow any concern there is because of Clarisonic,” says Alexander. “But when a large acquisition happens in our space and years later goes out of business, I think there’s going to be implications, and it’s going to be talked about. There is a lot people will learn from it.”

KEY TAKEAWAYS

- On Sept. 30, L’Oréal is shutting down Clarisonic. On the brand's website, the company explained, "This difficult decision was made so that L'Oréal can focus its attention on its other core business offerings."

- Clarisonic’s marriage with L’Oréal was tricky from the beginning. For the conglomerate specializing in skincare, cosmetics and haircare, electronics weren’t familiar territory.

- Clarisonic faced a range of competitors, from copycats undercutting its prices to device powerhouse Foreo, that ate into its market share.

- Stoking replenishment was a challenge for Clarisonic. It sold topical products to use with its devices, but they weren't significant sales drivers. It depended on infrequent brush head replacement purchases for replenishment.

- A lack of compelling product innovation also plagued Clarisonic. It delved into the makeup and men's categories, and tried an eye device, but nothing matched the volume or recognition of its facial brush.

- As millennial and gen Z consumers turned to social media and topical exfoliators, Clarisonic didn't keep up. It tried to offer options for sensitive skin, but couldn't shed the reputation that its devices are abrasive.

- Despite Clarisonic's demise, industry forecasters have prognosticated robust growth for the beauty device segment. As Clarisonic exits, emerging brands have opportunities to secure additional market share.

- Clarisonic’s stumbles will undoubtedly cause investors and strategic buyers to be extra careful about entering the beauty device arena.